property tax on leased car in ri

People leasing cars in the selected states that levy local motor vehicle taxes and fees generally pay them unless the lease agreement requires otherwise. Rhode island has some of the highest property taxes in the us as the state carries an average effective rate of 153.

Which U S States Charge Property Taxes For Cars Mansion Global

Vacant land combination commercial structures on rented land commercial condo utilities and rails other vacant land.

. Mississippi residents pay 875 with an effective rate of 35 while those in Rhode Island have a 346 rate and pay about 864. A Power of Attorney from the leasing company for the person signing the TR-1 form registration and title application. Virginia is a personal property tax state where owners of vehicles and leased vehicles are subject to an annual tax based on the value of the vehicle on January 1.

If you didnt already know the following states apply a Personal Property Tax on all leased vehicles. For example the 2017 tax bill is for vehicles registered during the 2016 calendar year. To register your leased vehicle in RI you will also need.

Vehicles registered in Providence RI are taxed for the previous calendar year. Excise taxes in Maine Massachusetts and Rhode Island. Motor Vehicle Excise Tax.

Leased and privately owned cars are subject to property taxes in Connecticut. Rhode Island has some of the highest property taxes in the US as the state carries an average effective rate of 153. While Rhode Islands sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

There are three components that determine how much each individual. Property tax treatment varies from state to state as well. When you lease a vehicle the car dealer maintains ownership.

The median annual property tax payment here is 4339. 3470 - apartments with six or more units. This makes the total lease payment 74094.

Fees can differ by dealer leasing company and by the statecountycity in which you live. Tax assessors bill the car dealer for vehicle taxes but whether or not they pass that on to you will be delineated in your lease contract. The car tax is not a real time tax.

Law360 September 4 2019 710 PM EDT -- A Rhode Island attorneys seven-year lawsuit seeking a refund of sales tax he had paid on property taxes levied on his leased vehicle. Leased vehicles can now be renewed online. Excise taxes in Maine Massachusetts and Rhode Island.

The same charge or fee can sometimes have different names depending on car company. 5 new shorehams real and personal property is assessed at 80 of. And motor vehicle registration fees in New Hampshire.

Rhode Island collects a 7 state sales tax rate on the purchase of all vehicles. For example if your bill of sale is dated July 26 2020 sales tax is due on or before August 20 2020. Important Information Regarding Sales Tax Customers are required to remit sales tax to the State in a timely manner.

3243 - commercial I and II industrial commind. Loudoun County levies a tax each calendar year on all motor vehicles trailers campers mobile homes boats and airplanes with situs in the county. Division of Motor Vehicles Financial Responsibility Section at 600 New London Avenue Cranston RI 02920 401 462-9246.

Understand How Car Leasing Fees Charges and Taxes Work. A TR-5 form VIN verification from a local police department. You are taxed on how many days out of 365 days of the year your vehicle is registered.

In the vast majority of cases the leasing agency pays the tax and the person leasing the car reimburses the leasing company as part of the monthly payment he added. For example if a lease on a Mercedes-Benz E-Class has a monthly price of 699 before tax and your sales tax rate is 6 the monthly lease tax is 4194 in addition to the 699 base payment. This page describes the taxability of leases and rentals in Rhode Island including motor vehicles and tangible media property.

For additional information please contact. West Warwick taxes real property at four distinct rates. Arkansas Connecticut Kentucky Massachusetts Missouri North Carolina Rhode Island Texas haha I always found it funny how when you flip the A and the E in Texas you get Taxes LOL Virginia West Virginia and.

Leasing company must have a valid RI leasing license and RI Division of Taxation tax permit number on file. For vehicles that are being rented or leased see see taxation of leases and rentals. That comes in as the tenth highest rate in the country.

A letter of permission from the leasing company for the out of state transfer. Leased and privately owned cars are subject to property taxes in Connecticut. You can find these fees further down on the page.

A tax charged on top of another tax sounds outrageous but the NBC 10 I-Team learned its real deal for some Rhode Island driversIts a complaint the NBC 10 I. 2989 - two to five family residences. Sales tax on vehicle sales is due on the 20th day of the month following the month in which the sale took place.

It appears that momentum to reform the states most hated tax. Understanding Rhode Islands Motor Vehicle Tax March 2017 Summary of Rhode Islands Car Tax The Motor Vehicle Tax commonly known as the ar Tax is a property tax collected by each Rhode Island municipality based on the value of each motor vehicle owned. By Matthew Nesto.

People leasing cars in the selected states that levy local motor vehicle taxes and fees generally pay them unless the lease agreement requires otherwise. Multiply the base monthly payment by your local tax rate. In addition to taxes car purchases in Rhode Island may be subject to other fees like registration title and plate fees.

In car leasing as in buying there can be charges fees costs and taxes that often surprise newcomers. To learn more see a full list of taxable and tax-exempt items in Rhode Island. Property tax on leased car in ri.

If you do pay the personal property tax you can deduct it. And motor vehicle registration fees in New Hampshire. Leased vehicles are subject to Rhode Islands annual motor vehicle excise tax which is based on motor vehicle values and locally set rates RI.

Nj Car Sales Tax Everything You Need To Know

Do You Pay Road Tax On Leased Cars Leasecar Blog

Virginia Sales Tax On Cars Everything You Need To Know

What S The Car Sales Tax In Each State Find The Best Car Price

What Is Total Loss Car Insurance Bankrate

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

Nbc 10 I Team Drivers Who Lease Cars Complain Of Double Tax Wjar

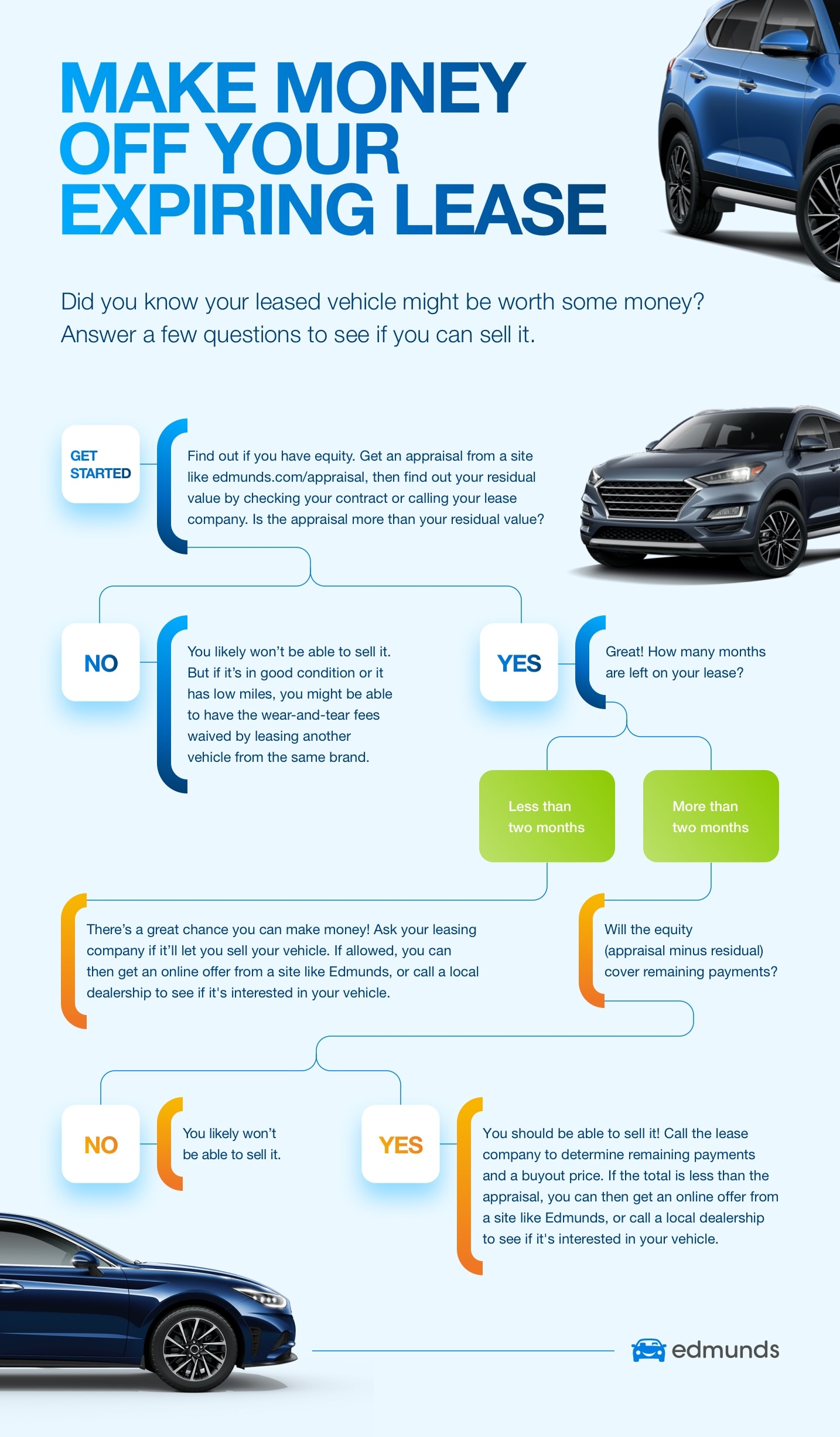

Consider Selling Your Car Before Your Lease Ends Edmunds

Finance Lease Market Know Applications Supporting Impressive Growth Finance Lease Finance Marketing Data

The States With The Lowest Car Tax The Motley Fool

Honda Lease Center In Middletown Ri Saccucci Honda

/https://www.forbes.com/wheels/wp-content/uploads/2020/09/Porsche-911-subscription.png)

Car Subscription Services The Complete Guide To Getting The Car You Want Forbes Wheels

How To Gift A Car A Step By Step Guide To Making This Big Purchase

Out Of State Car Buyers Use Montana Llc S To Evade Taxes News Bozemandailychronicle Com