venmo tax reporting limit

You are required to meet government requirements to receive your ITIN. Illinois and New Jersey have a 1000 1099-K threshold plus for Illinois a requirement of at least four.

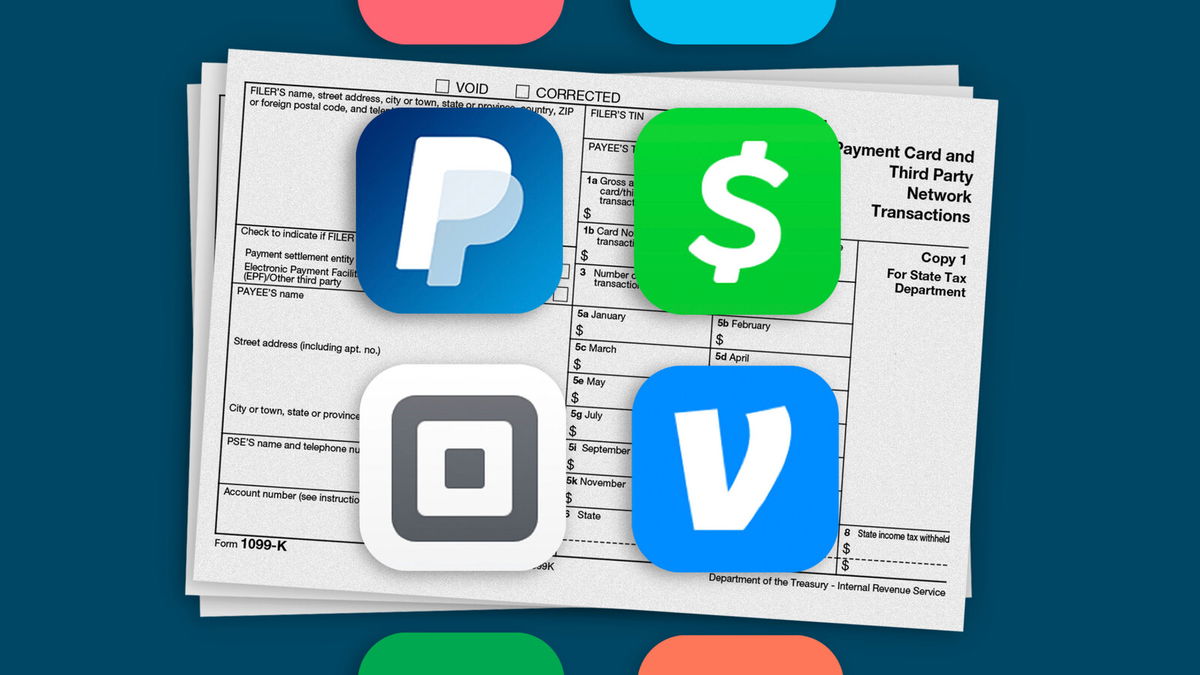

Venmo Paypal Cash App Must Report Payments Of 600 Or More To The Irs R Technology

Venmo is an app that lets you send or receive money.

. Several states have already closed this reporting loophole on the state level. Government for tax reporting only. To use the app you may connect Venmo to your bank account or set up mobile check deposits.

Typically that income would be reported on a 1099-R. For tax years beginning after 2017 applicants claimed as dependents must also prove US. Before the limit was way higher like 20000 and 200 transactions.

This is a catch-all form for reporting income that isnt appropriate to include on any of the other forms. Some types of income that. Sites like Venmo and PayPal now must report business transactions to the IRS when they total 600year.

Venmo has a debit card and credit card. Maryland Massachusetts Mississippi Vermont and Virginia require a 1099-K to be filed with the state tax agency if a TPSO pays a state resident 600 or more during the year. Arkadiy Eric Green CPA is a director of Tax Services with Berkowitz Pollack Brant where he works with real estate companies commercial and residential developers property management companies real estate investors and high-net-worth individuals to structure investments and complex transactions for maximum tax efficiency.

An ITIN is an identification number issued by the US. Before the limit was way higher like 20000 and 200 transactions. So you can see for most people who are small business owners entrepreneurs gig workers that -.

Having an ITIN does not change your immigration status. In some cases income you withdraw from qualified retirement plans may need to be reported for deferred tax purposes. About the Author.

So you can see for most people who are small business owners entrepreneurs gig workers that -. Additional fees and restrictions may apply. Congress updated the rules in.

Venmo Paypal Cash App Must Report Payments Of 600 Or More To The Irs R Technology

Wilklow Associates Cpa Pc On The New 600 Reporting Requirement For Digital Payment Apps

Venmo Paypal Cash App Must Report Payments Of 600 Or More To The Irs R Technology

Venmo Paypal Cash App Must Report Payments Of 600 Or More To The Irs R Technology

/cloudfront-us-east-1.images.arcpublishing.com/gray/VGFJPQ3KWRCWLN2NCMVB57LQ5U.jpg)

Irs Announces Changes For Cashapp Venmo Users

Venmo Paypal Cash App Must Report Payments Of 600 Or More To The Irs R Technology

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Abc17news

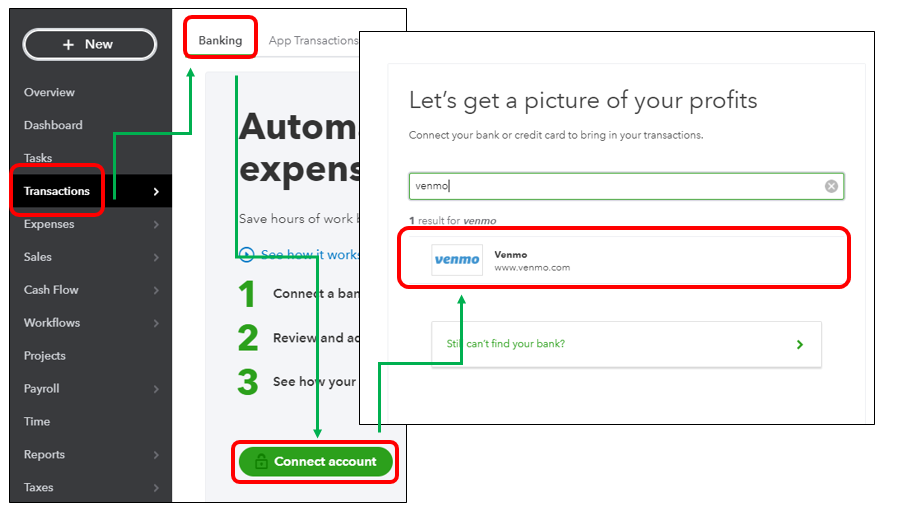

How To Use Venmo For Business A Complete Guide Wise Formerly Transferwise

Us Stimulus Did Not Include New Tax On App Payments Fact Check

New Tax Rule Requires Paypal Venmo Cash App To Report Annual Business Payments Exceeding 600

As A Freelancer Do I Have To Pay Income Taxes For Venmo And Bank Transfers Quora

New 600 Limit On 1099k Walkthrough Venmo Cashapp Etsy Paypal Ebay Youtube

Venmo Paypal Cash App Must Report Payments Of 600 Or More To The Irs R Technology

/cloudfront-us-east-1.images.arcpublishing.com/gray/VGFJPQ3KWRCWLN2NCMVB57LQ5U.jpg)

Irs Announces Changes For Cashapp Venmo Users

2022 Tax Pocket Guide Individual And Corporate Tax Rates St Louis Tax Planning

New Tax Law Sell More Than 600 A Year Venmo Paypal Stripe And Square Must Report Your Income To The Irs